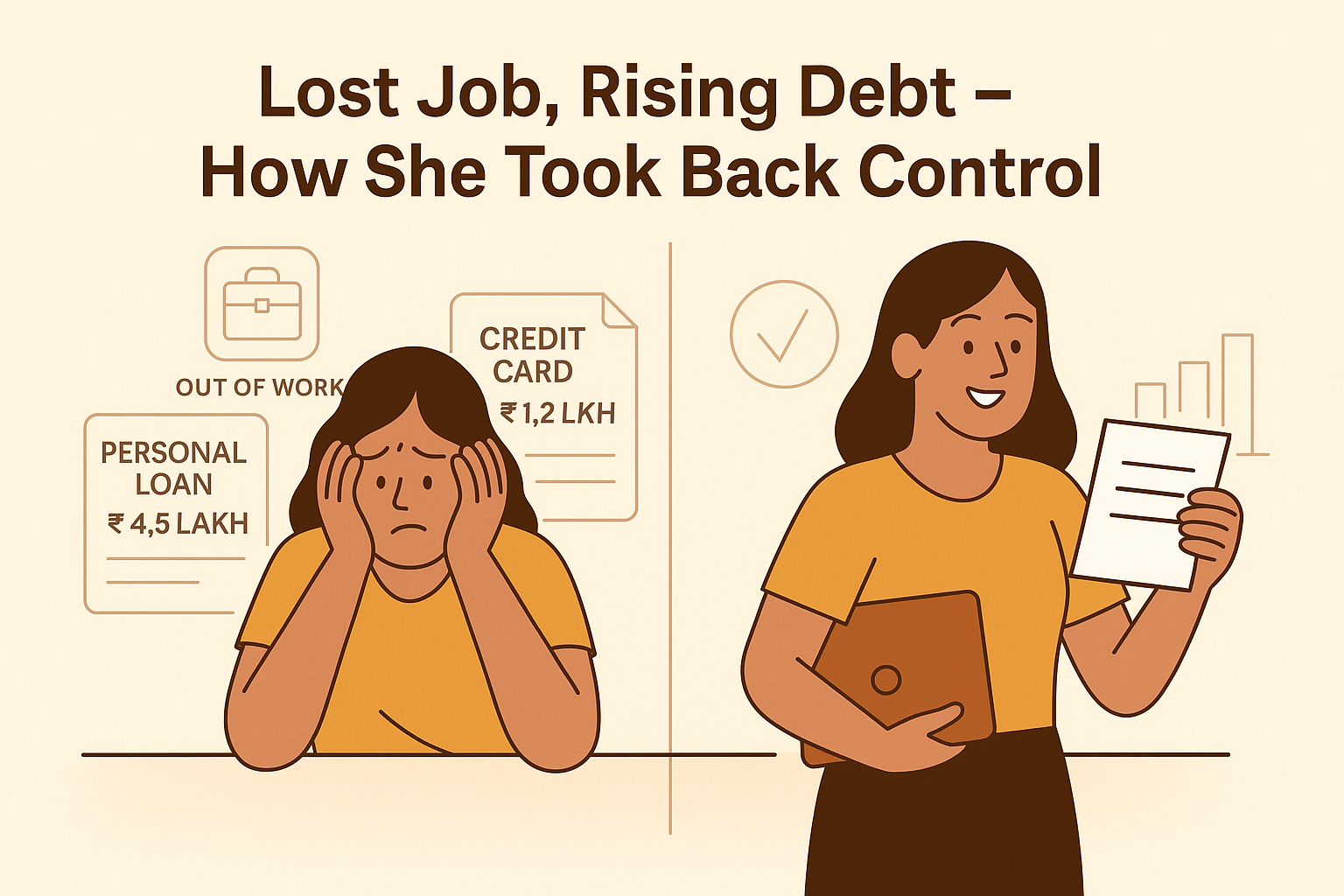

Case Study 09: “Lost Job, Rising Debt – How She Took Back Control”

Background

Priya, a 29-year-old marketing executive, was earning ₹45,000 per month in a metro city. She had multiple EMIs – a personal loan of ₹4.5 lakh, a credit card bill of ₹1.2 lakh, and an education loan EMI of ₹6,000. Everything was under control until she suddenly lost her job during a company restructuring.

The Problem

- Within two months, Priya’s savings were nearly gone.

- Credit card companies began calling daily, demanding payment.

- The personal loan EMI bounced twice, leading to penalty charges.

- She was scared of legal action and didn’t know her rights.

How Lawfully Finance Helped

- Debt Analysis: We reviewed all her EMIs, interest rates, and due dates to identify the most critical debts.

- Bank Negotiation: We helped her approach the personal loan bank for a temporary EMI moratorium.

- Credit Card Settlement: We guided her in negotiating a reduced settlement amount with the credit card company by showing proof of unemployment.

- Legal Awareness: She learned how to handle recovery calls confidently without falling for intimidation tactics.

- Budget Reset Plan: We helped her create a strict expense plan and guided her to take freelance work to cover essential payments.

Results After 4 Months

✅ EMI moratorium approved for 3 months, avoiding further penalties.

✅ Credit card debt reduced from ₹1.2 lakh to ₹85,000 via settlement.

✅ No harassment calls after she exercised her rights.

✅ Started building a side income that continued even after getting a new job.

Key Takeaways

- Job loss doesn’t have to mean financial collapse – early action can prevent the worst.

- Always inform banks about genuine hardships before defaults pile up.

- Knowing your rights is the best shield against harassment.