No more Unmanageable

Debt, Only Lawfully

4.6

700+ Reviews

1500 cr+

Debt Enrolled

12,000+

Accounts Resolved

30,000+

Happy Customers

Say Goodbye to overdue loans, Hello to a Better Future

Multiple Loans, 1 Simple Solution!

Insights For Your

Financial Wellness

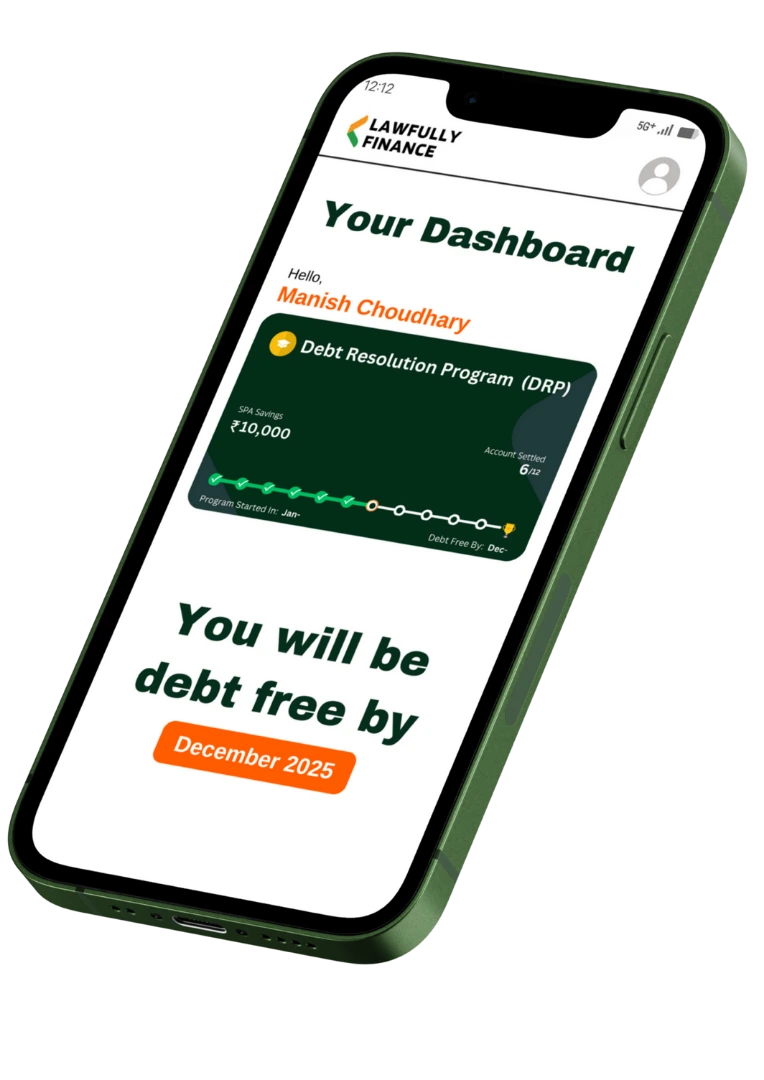

Eliminate Your Debt with

Lawfully Finance's Debt Relief Program

- Smart Savings Approach

- Personalized Debt Solutions

- Pay Us Only When Your Debt is Settled

(This is NOT a Loan; You Clear Your Debt Using the Funds You Save in Your Dedicated Account.)

Real People. Real Success.

Thousands have broken free from debt with Lawfully Finance. Now its your turn!

Latha N.

“The online support team was incredibly responsive. Their portal made uploading documents and checking updates a breeze!”

Anjali S

“Lawfully Finance’s website made everything so easy—clear steps, friendly interface, and I felt supported from day one!”

Ravi M.

“I loved how transparent Lawfully Finance was. Their online portal guided me through each stage with confidence.”

Priya K.

“Navigating the debt consolidation process felt stress-free thanks to Lawfully Finance’s user-friendly site and prompt responses.”

Amit T.

“Every question I had was answered quickly on their platform. Lawfully Finance’s digital experience is top-notch!”

Sneha R.

“The step-by-step guides on their website were super helpful. I always felt in control of my financial journey.”

Suresh B.

“Everything from document upload to progress tracking happens seamlessly on Lawfully Finance’s platform.”

Top Picks for You

Frequently Asked Questions (FAQs)

Can I speak to a real person before joining?

Yes. Book a ₹299 consultation call — refundable if you enroll.

My account is frozen. How can I receive salary again?

We teach you how to shift to a new salary account and protect incoming funds.

I defaulted on apps like Kreditbee, LazyPay, ZestMoney. Will this help?

Yes. Works for all unsecured loans and apps.

Will someone help me if I get stuck?

Yes. Human support is free forever — no ₹299 charge. You can chat or WhatsApp us directly.

Can I apply for loans again after default?

Yes, but with planning. Module 14 gives you a clear path after score improvement.

I received a Lok Adalat notice. Do I need to go?

Yes, but with planning. Module 14 gives you a clear path after score improvement.

Can I really improve my credit score?

Yes. You’ll get a full repair plan, bureau methods, and follow-up tricks