Why Indians Believe “Somehow It Will Work Out” – A Case Study | Lawfully Finance

In countless Indian homes, one sentence quietly delays action for months—sometimes years:

“Kuch na kuch ho hi jayega” (Somehow it will work out).

This belief offers emotional comfort in difficult times, but when it comes to debt, it often becomes a silent trap. Instead of solving the problem, it postpones it—until stress, penalties, and pressure explode.

This case study explains why this mindset is so common, how it harms borrowers, and what actually works instead.

The Comfort of Hope Over Planning

Indian culture values optimism and resilience. Families are taught to:

- Adjust rather than confront

- Trust fate during hardship

- Believe things improve with time

- Avoid “negative thinking”

While this helps emotionally, it becomes risky when applied to financial obligations.

Case Study: Amit’s Story (Name Changed)

Amit, a 36-year-old salaried employee, had:

- 2 credit cards with rising balances

- 1 personal loan

- Monthly EMIs taking nearly 45% of his salary

Every month, Amit told himself:

“Next appraisal will fix this.”

“Bonus aane wala hai.”

“Abhi thoda adjust kar leta hoon.”

For 18 months, he survived on hope—not strategy.

Where “Somehow” Started Breaking Down

Initially:

- Minimum dues were paid

- Calls were manageable

- Stress felt temporary

But slowly:

- Interest increased

- Credit limits maxed out

- Recovery calls intensified

- Sleep and focus reduced

Hope stopped helping—pressure started dominating.

Why This Mindset Is So Common in India

This belief survives because:

- Income growth is expected

- Family support is assumed

- Past struggles eventually passed

- Talking about money feels uncomfortable

Borrowers confuse hope with a plan.

The Hidden Danger of Waiting

“Somehow” delays action because:

- It avoids uncomfortable decisions

- It postpones tough conversations

- It masks urgency

But debt doesn’t wait. While hope stays still:

- Interest compounds

- Options reduce

- Negotiation power weakens

Time works against the borrower.

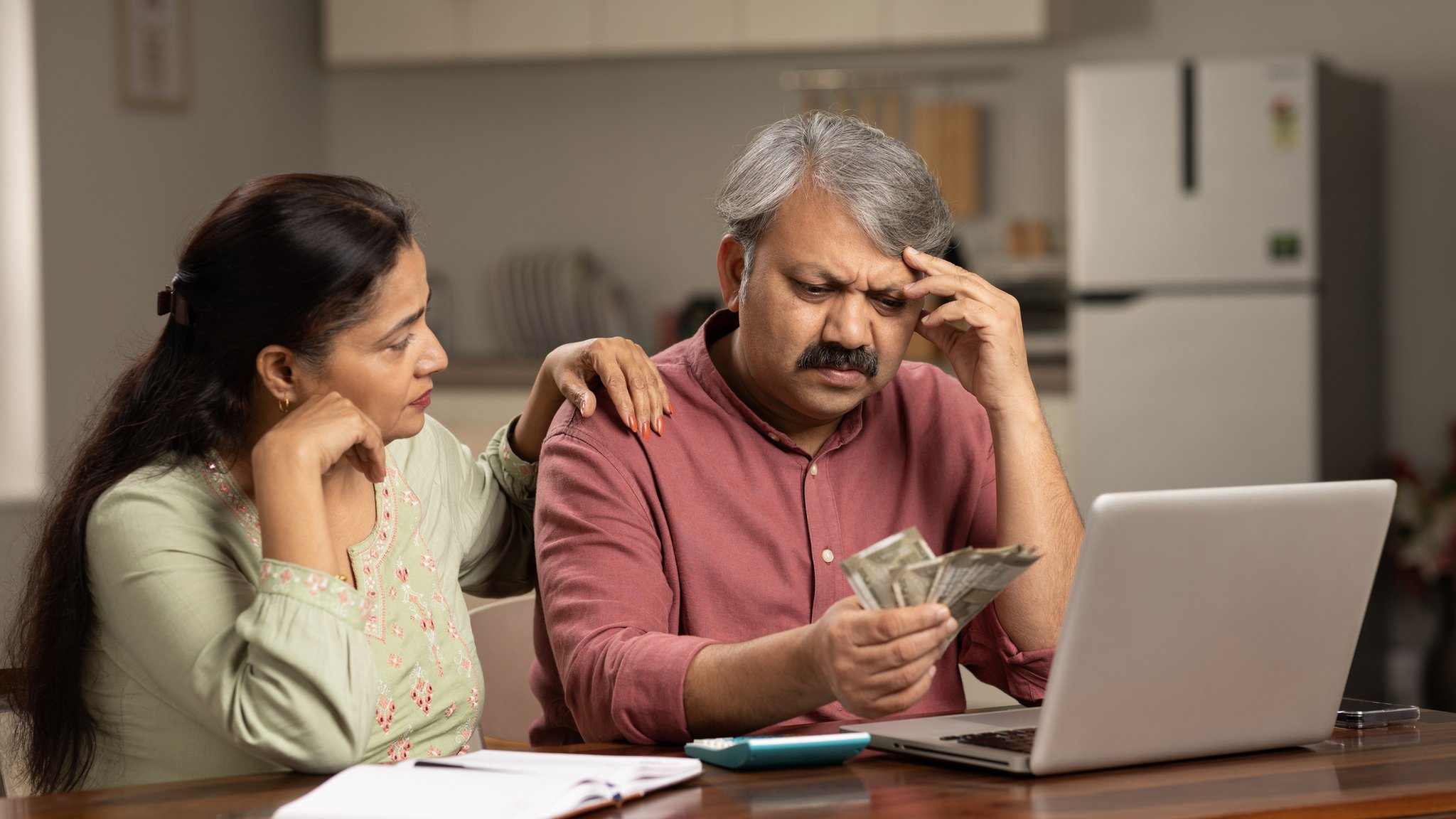

Emotional Reasons Borrowers Hold On

Borrowers hold this belief due to:

- Fear of admitting stress

- Shame around asking for help

- Pride in “managing alone”

- Avoidance of legal or bank conversations

Hope feels safer than facing reality.

What Changed for Amit

When recovery pressure reached his workplace, Amit finally sought guidance.

What changed wasn’t income—it was clarity:

- Total debt was mapped

- Reality was faced calmly

- A structured plan replaced assumptions

- Communication pressure reduced

Amit said:

“I wish I acted before hope turned into panic.”

Why “Somehow” Is Not a Strategy

Hope is emotional relief, not financial planning.

Without structure:

- Debt grows quietly

- Stress multiplies

- Control is lost

Hope must be supported by clear steps.

What Works Better Than Blind Optimism

Instead of waiting:

- Assess total debt early

- Understand legal and financial options

- Communicate before escalation

- Create a realistic plan

- Seek professional guidance

Action converts hope into progress.

How Lawfully Finance Replaces “Somehow” With Structure

Lawfully Finance helps borrowers:

- Replace assumptions with clarity

- Stop panic-driven waiting

- Understand real options

- Reduce harassment and fear

- Create lawful, sustainable resolution plans

We don’t remove hope—we support it with planning.

Final Thought

Believing “somehow it will work out” is human.

But debt doesn’t resolve on hope—it resolves on clarity and action.

Hope should give you courage to act, not reasons to wait.

👉 If you’re stuck in the “somehow it will work out” phase, take the first step toward real clarity with Lawfully Finance:

https://lawfullyfinance.com/step/sign-up/